Mean/Variance Optimization

markowitz (var* Covariances, var* Means, int N, var Cap) : var

markowitz (var* Covariances, var* Means, int N, var* Caps) : var

Performs a mean / variance optimization (MVO) using the

algorithm from the 1959 publication Portfolio Selection: Efficient

Diversification of Investments by Harry M. Markowitz;

also referred to as modern portfolio theory

(MPT). The fucntion calculates the optimal distribution of capital

among a portfolio of assets or algorithms for achieving a given total return or

variance. The algorithm starts with assigning all capital to the component with

the highest return. It then adds or removes more components step by step,

calculating the optimal return/variance combination on any step.

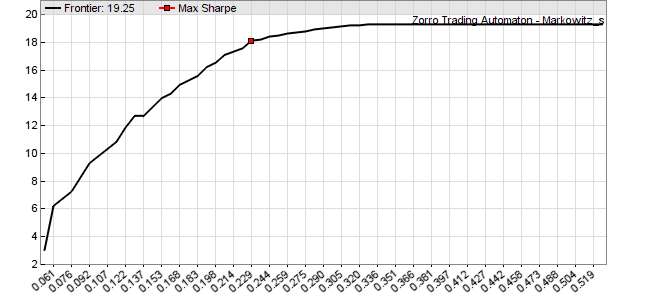

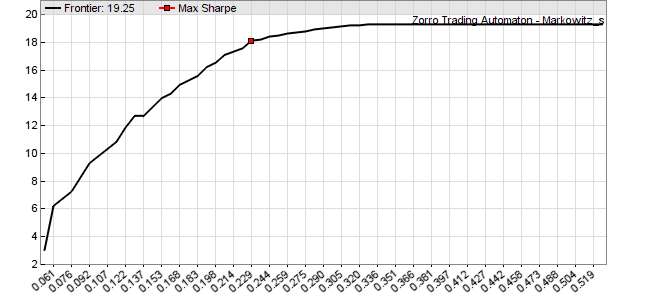

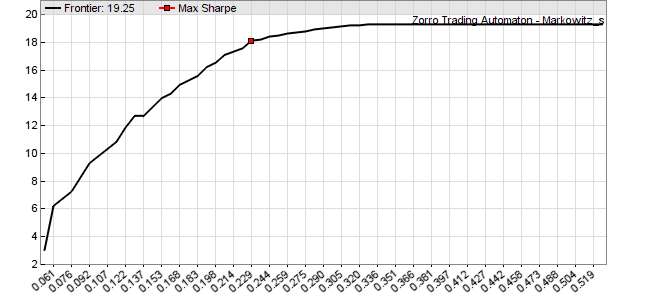

The

efficient frontier

is a line consisting of corner points in a return over variance plot. At any

corner point the portfolio composition changes by adding or removing one or

several components. Between the corner points the included components don’t

change, only their capital allocation changes linearly. Connecting all corner

points with lines establishes the efficient frontier with the

maximum return for any given variance (see image).

Efficient frontier of an ETF portfolio, x axis = variance,

y axis = annual return in %

Parameters:

| Covariances |

A var[N*N] array containing the covariance matrix

of the component returns. |

| Means |

A var[N] array containing the mean of the component

returns. |

| N |

Number of components, at least 3. |

| Cap |

Weight cap in 0..1 range; soft weight limit of a

single asset at the minimum variance point, or 0 for no

weight cap. |

| Caps |

A var[N] array containing individual weight limits

in 0..1 range, or 0 for no weight cap.

|

Returns

Variance at the efficient frontier point with the best Sharpe Ratio (i.e. return

divided by standard deviation), or 0 if the efficient frontier

could not be calculated. The efficient frontier line segments are internally

stored for subsequent markowitzReturn or

markowitzVariance

calls.

markowitzReturn (var* Weights, var Variance) : var

Calculates the return and the optimal capital allocation weights for a given

variance at a previously calculated efficient frontier. The markowitz()

function must be called before for calculating the frontier.

markowitzVariance (var* Weights, var Return) : var

Calculates the variance and the optimal capital allocation for a given return at

a previously calculated efficient frontier. The markowitz()

function must be called before for calculating the frontier.

Parameters:

| Weights |

A var[N] array to be filled with the capital

allocation weights of the N portfolio components. The

sum of the weights is 1. Pass 0 when

no weights are needed.

|

| Variance |

The desired variance. When below the lowest variance, the return and

weights at the left end of the efficient frontier are returned. |

| Return |

The desired return. When below the lowest return of the efficient

frontier, the variance and weights at the left end of the efficient

frontier are returned.

|

Returns

The optimal portfolio return at the given variance, or vice versa..

Modifies

Weights - set to the capital allocation weights.

Remarks:

- For getting the minimum variance point, call markowitzReturn

with Variance at 0. For maximum Sharpe

ratio, call markowitzReturn with the Variance

returned by markowitz(). For the maximum return point at

the right side of the diagram, call markowitzReturn with

Variance

at 1. For the maximum and minimum variances, call

markowitzVariance

with a return value above or below the maximum and minimum portfolio return.

- Markowitz weights can be used alternatively to

OptimalF

factors for allocating capital to a portfolio system. Unlike

OptimalF, they require only a relatively short time horizon and

thus can be adapted during live trading. For a long-term ETF rotation

strategy, use the last year price returns of the ETFs (see example) and

recalculate their markowitz weights every 4 weeks.

- For converting weights to asset amounts, multiply the weights with your

budget and divide by asset prices.

- For calculating the returns of portfolio components with currently zero

weight in real time, use phantom trades.

- It is often recommended to limit the asset weights with the Cap

or Caps parameter (f.i. 0.33 for 33%

maximum weight) for getting a higher portfolio diversification. This makes

the portfolio more stable and usually produces better out-of-sample results.

The weight cap can be exceeded when it is too small and the resulting

weights don't sum up to 1. For useful results, the weight cap should be at

least two or three times the 1/N minimum.

- MVO fails when there is no point on the efficient frontier that

represents the portfolio, for instance when all means are negative. This can

lead to weights of zero or to a total weight less than 1.

- Applications of the markowitz function are described in

the Financial Hacker article

Get Rich Slowly.

- The Z8 and Z10 trading systems use this

function for calculating optimal portfolio compositions. For other ways of

allocating capital, see the OptimalF,

distribute, and knapsack algorithms.

Example:

#define N 10 // 10 assets

#define DAYS 252 // 1 year

vars Returns[N];

var Means[N];

var Covariances[N][N];

function run()

{

BarPeriod = 1440;

StartDate = 20150101;

LookBack = DAYS;

string Name;

int n = 0;

while(Name = loop(.../*list of some assets*/ ... ))

{

asset(Name);

Returns[n] = series((price(0)-price(1))/price(1));

Means[n] = SMA(Returns[n],DAYS);

n++;

}

int i,j;

if(!is(LOOKBACK))

{

// generate covariance matrix

for(i=0; i<N; i++)

for(j=0; j<N; j++)

Covariances[i][j] = Covariance(Returns[i],Returns[j],DAYS);

// calculate efficient frontier

var OptimalV = markowitz(Covariances,Means,N);

printf("\nBest daily return %.3f %% at variance %.4f",

100*markowitzReturn(0,OptimalV),OptimalV);

// plot the frontier

for(i=1; i<70; i++) {

var VStep = i*OptimalV*0.03;

var Return = markowitzReturn(0,VStep);

plotBar("Frontier",i,VStep,Return,LINE|LBL2,BLACK);

}

plotGraph("Max Sharpe",1./0.03,markowitzReturn(0,OptimalV),SQUARE,RED);

PlotScale = 6;

PlotHeight1 = 300;

quit("");

}

}

See also:

OptimalF, Covariance,

distribute, knapsack

► latest version online