Interactive Brokers Bridge (Zorro S)

Interactive Brokers™ offers access to most major exchanges, a huge number of supported assets

including options and futures, and low trading costs. The IB bridge gives Zorro

algo trading strategies direct access the IB API, either

through IB's Trader Workstation (TWS), or through the IB Gateway.

The TWS is preferable for testing a script, the Gateway for automated

trading. The TWS, a bloated java program, normally stops every 24 hours and interrupts the connection.

The Gateway lasts a bit longer and usually disconnects every weekend. Thus,

long-term algo trading with the IB API requires supervising the trading system and

restarting the Gateway every Monday. When downloading TWS or Gateway from the IB website, get the release

(stable) version, not the beta (unstable) version.

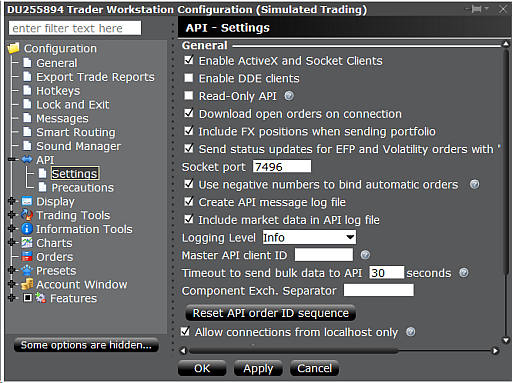

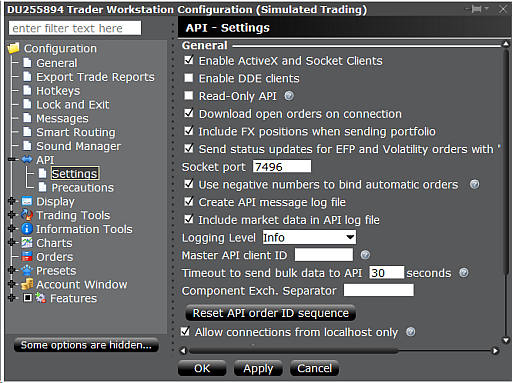

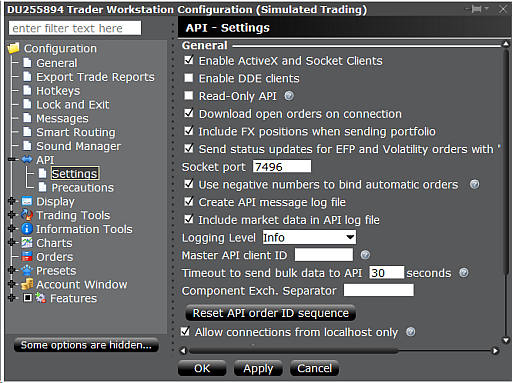

For trading with the TWS, open File/Global Configuration/API/Settings (see screenshot below) and select Enable ActiveX and Socket Clients. Make sure that the socket port is set to 7496. Deselect Read-Only API when you want to send orders.

Make sure that Allow connections from localhost only

is checked. Enter an individual number from 101..108 in Zorro's User field for connecting to the TWS via socket port

7496. The Password field can be left empty.

For trading with Gateway, select IB API (not FIX CTCI). Open Configuration/API/Settings and make sure that the socket port is set to 4002. Enter an individual number from 1..8 in Zorro's User field for connecting to the Gateway via socket port

4002. The Password field can be left empty.

Other socket port numbers than 7496 or 4002 can be set up in the

Server field of the account list (see below). Up to 8 Zorros can connect to the same Gateway or to the same TWS,

but each connection needs a separate IB.dll. Use DLL copies as

described under Broker Arbitrage. Note that only a single TWS or a single Gateway per

user is supported by IB. The connection will break down when a second Gateway or TWS instance

with the same user is opened, even on a different PC.

Zorro login fields for IB:

| User: |

1 .. 8 for the Gateway,

101 .. 108 for the TWS |

| Password: |

Empty |

Asset list example: AssetsIB.csv

Accounts.csv example entries:

| Name |

Server |

Account |

User |

Pass |

Assets |

CCY |

Real |

NFA |

Plugin |

| IB-TWS-Demo |

|

D4567890 |

101 |

0 |

AssetsIB |

USD |

0 |

14 |

IB |

| IB-TWS-Real |

|

U1234567 |

101 |

0 |

AssetsIB |

USD |

1 |

14 |

IB |

| IB-Gateway |

4002 |

U1234567 |

1 |

0 |

AssetsIB |

USD |

1 |

14 |

IB |

Trading with IB. Rebalancing portfolios

The IB plugin included with the free Zorro version supports paper trading accounts that begin with the letter "D". A plugin for

real accounts is included in Zorro S. For opening an account with IB, the normal choice is a

RegT Margin account. If you own Zorro S

and trade high volumes, consider a Portfolio Margin account with its lower margin costs.

At the time of this writing, IB paper trading accounts were only available after opening a real account.

Due to the high margin and lot size requirements, the Forex/CFD trading

Z systems are not really suited for IB.

They would require a large Capital

setup for not skipping too many trades, and even then achieve less annual return due to the low leverage. The main advantage of IB is

support of many exchanges, so that a large range of financial assets can be traded. This allows many new trade systems that exploit specific inefficiencies, f.i. volatility, or seasonal effects of particular stocks or treasuries.

Unadjusted historical price data for backtests can be downloaded from IB,

with limits to the data resolution and maximum number of years. In second

resolution only a few days of data are normally available. Unadjusted and

adjusted EOD data is also available from many other Internet sources, f.i. from Yahoo,

Stooq, or Quandl by using the Download script or the assetHistory or dataDownload functions.

Assets symbols can be defined in a way that live data

is loaded from IB and historical EOD data from another source.

For rebalancing portfolios, the script can

either adjust positions directly through enter/exit

commands, or generate a CSV file containing the desired asset percentages. This

file can then be manually imported in the TWS window

Portfolio Tools / Rebalance Portfolio and will produce orders for

adjusting the positions. The required CSV format changes from time to time, so

export first an example file from the TWS and use it as template for the file

generated by your script. An example file that rebalances a Z9 portfolio:

DES,XLU,STK,SMART/AMEX,,,,,,0.0

DES,SMH,STK,SMART/AMEX,,,,,,12.5

DES,XBI,STK,SMART/AMEX,,,,,,17.0

DES,XLI,STK,SMART/AMEX,,,,,,0.0

DES,XLV,STK,SMART/AMEX,,,,,,11.4

DES,VGK,STK,SMART/AMEX,,,,,,0.0

DES,VOO,STK,SMART/AMEX,,,,,,0.0

DES,UUP,STK,SMART/AMEX,,,,,,0.0

DES,VCSH,STK,SMART/AMEX,,,,,,0.0

DES,HYG,STK,SMART/AMEX,,,,,,0.0

DES,TLT,STK,SMART/AMEX,,,,,,20.0

DES,IAU,STK,SMART/AMEX,,,,,,19.0

DES,AGG,STK,SMART/AMEX,,,,,,0.0

DES,SPY,STK,SMART/AMEX,,,,,,0.0

For trading an asset, some prerequisites must be fulfilled:

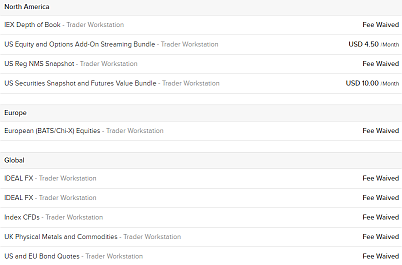

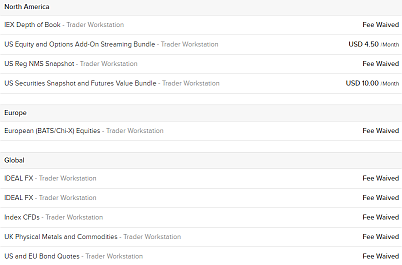

- Subscribe market data on the IB website.

Otherwise you'll get a "market data

is not subscribed" error message at session start. Forex market data is free, most other data requires a monthly fee.

Delayed data is not available via API. For subscribing market data, enter your IB account management page, and select

User Settings / Market Data. For usual US stocks and ETFs, subscribe

both the "U.S. Securities Snapshot and Futures Value Bundle" and the

"US Equity and Options Add-On Streaming Bundle".

If you're a private trader, make sure that your account has

no 'professional'

status, otherwise your subscription fees will multiply. For finding out which subscription you need for which asset, enter the asset

in the Favorites window of the TWS, then right click on it. If the asset is

not yet subscribed, select Subscribe Market Data and

you'll be led to a web page where you can subscribe it. For trading on a

paper

account, activate Share Market Subscription

in the account settings for sharing your subscriptions with the paper trading account.

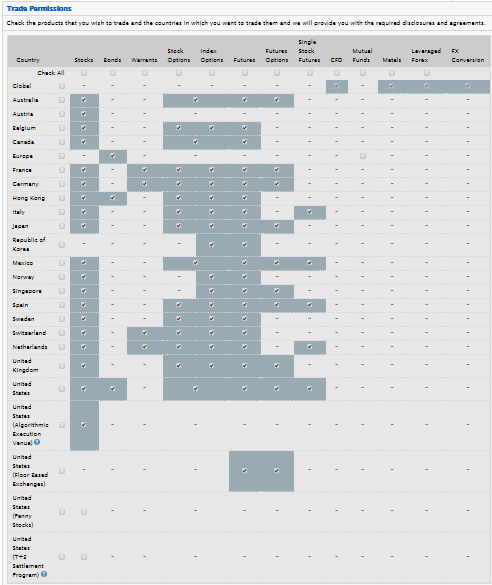

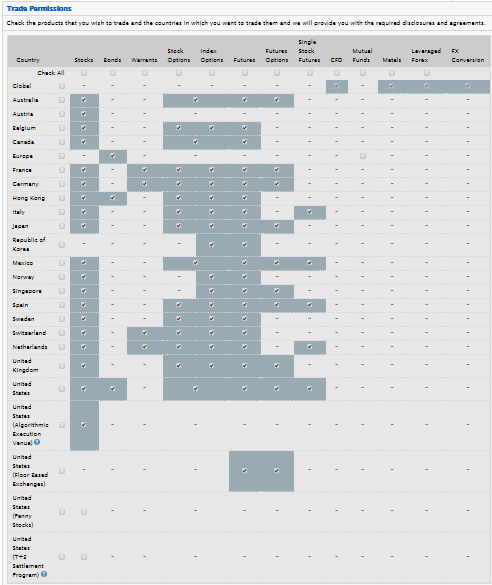

- Obtain trading permission from IB for all asset types you want to trade, under Trade Configuration / Permissions (see image below). You must fill in a form about your trading experience and your financial situation. It takes about 24 hours to get approval for trading all asset types. Penny stocks require a special approval.

- Bypass restrictions and precautions. Open File / Global Configuration / API / Precautions and enable

Bypass Order Precautions for API Orders and

Bypass redirect order warning. Otherwise orders

will need manual confirmation to be transmitted, or you'll get an "over limit" error message.

Under Presets you can also change precaution limits individually per asset type.

- Make sure that all traded assets are listed in the TWS Monitor and their prices are visible before connecting to IB (even when using the Gateway). A system can not be started when its assets prices or history are currently not available due to

missing market subscriptions or other reasons.

- Check if local regulations permit trading

the assets on your account. For instance, US citzens can be prohibited from

trading CFDs or limited in the number of trades per week. European citizens

are normally not allowed to trade US ETFs.

Not all assets can be traded all the time, and not all price types are

available for all assets. Index (IND)

assets are read only, but you can trade indices with ETFs, Futures, or CFDs. Some assets, such as

specific CFDs, are not available to US citizens, and require an UK or other account outside the US.

European traders are not allowed, thanks to EU regulations, to trade US ETFs. The default minimum sizes for currency pairs are in the 20,000 contracts range, but entering a lower minimum size in the asset list is also possible. Orders are then marked as 'odd lot' and cause higher transaction costs. Some stocks (STK) and some other assets

are not shortable, either permanently or dependent on market liquidity. Short trades for closing a long position are normally

always accepted.

For setting up the IB asset list and for simulating IB trading in the

backtest, margin requirements can be found on

https://www.interactivebrokers.com/en/index.php?f=24176. The

maintenance or end-of-day margin is often higher than the initial margin.

IB symbols

Any asset you want to trade must be represented by a line in the asset list.

The asset symbols (Symbol column) are converted to IB

contracts in the following way:

- It a symbol has a '/' slash at the 4th position (f.i. EUR/USD),

it is assumed a forex pair. Is is split in currency (first three characters) and counter currency (last three characters), gets the asset type CASH and is routed to the IDEALPRO exchange.

Forex pairs are displayed with a dot (f.i. EUR.USD) in the TWS, and the purchased amount is listed separately per currency in the TWS account window.

IB announced that they are gradually removing Forex pair support from the API version used by the plugin, so not all Forex pairs

might be available in future versions.

- If the symbol contains no slash and no hyphen (f.i. AMZN), is it assumed a

US stock or ETF. SMART routing with primary exchange ISLAND

is used. These parameters work for most US stocks and ETFs, except

when the asset is traded at several different exchanges or when the same symbol

is also used for other assets types such as futures or CFDs. Then the full symbol name

with exchange and currency must be given, see below.

- Symbols containing '-' hyphen characters are split in separate strings as

described under Symbols. String 1 is the

ticker name, string 2 the

asset type (STK, OPT, FUT, FUTX, IND, FOP, WAR, CASH, CFD, STKCFD, FUND, EFP, BAG, BOND, CMDTY), string 3 the

exchange and string 4 the

counter currency. If the currency is omitted, USD is assumed. If the exchange is omitted,

SMART is used with

ISLAND as primary exchange. Examples: AAPL-STK-NYSE-USD, XAGUSD-CMDTY,

EUR-CFD-SMART-USD, GLD-STK-SMART/ARCA-USD.

If an asset is traded on several exchanges in different

countries or time zones, you can receive a message like "Contract

description is ambiguous" at the time when market hours overlap. In

this case you must have the exchange code and/or the currency in the asset symbol, like "*-STK-NYSE-USD".

- The following exchange codes are supported: SMART,

AMEX,

ARCA,

BELFOX,

BOX,

BRUT,

BTRADE,

CBOE,

CBOT,

CFE,

CME,

DTB,

E-CBOT,

ECBOT,

EUREX US,

FOREX,

FTA,

GLOBEX,

HKFE,

IBIS,

ICE,

IDEM,

IDEALPRO, ICEEU,

ISE,

ISLAND,

LIFFE,

LSE,

MATIF,

ME,

MEFFRV,

MONEP,

NYBOT,

NYMEX,

NYSE,

ONE,

OSE.JPN PHLX,

PSE,

SNFE,

SOFFEX,

SUPERMONTAGE,

SWX,

TSE,

TSE.JPN,

TSX,

VIRTX,

XETRA. If a primary exchange is required, add it with a slash (f.i.

SMART/LSE). US stocks normally require ISLAND

as primary exchange, European stocks normally require an empty string (SMART/)

that allows to select the primary exchange automatically. Some info about exchange

codes can occasionally be found in the IB documentation; otherwise

experimenting is required for finding the correct combination of exchange

and primary exchange. Symbols that work for retrieving prices and

positions do not always work for placing orders, and symbols for the

underlying do not always work for options (see below).

- Options have symbols in the format Ticker-OPT-Expiry-Strike-Put/Call-Exchange, f.i.

AAPL-OPT-20191218-1350.0-C-GLOBEX. Futures have symbol names in the format

Ticker-FUT/FUTX-Expiry-TradingClass-Exchange(-Currency), f.i. SPY-FUT-20191218-SPY1C-GLOBEX.

Alternatively to the expiry date, a contract month symbol can be used, f.i.

ESH9 for the ES 2019 March contract. If the trading

class of a future is not required, f.i. for ES, use the

ticker name instead: ES-FUT-20200319-ES-GLOBEX.

Options on futures have symbol names in the format

Ticker-FOP-Expiry-Strike-Put/Call-TradingClass-Exchange, f.i.

ZS-FOP-20191218-900.0-C-OSD-ECBOT. If the currency is

ambiguous or is different to USD, append it at the end, like

DAX-FUTX-20171217-FDAX-DTB-EUR. The symbols are automatically generated

when calling the contract function.

- Two special symbol types are supported by the IB bridge. The type STKCFD trades as a

CFD, but gets the price quotes and historical prices of the underlying stock. This is useful for stock CFDs (f.i. AAPL-STKCFD) which can be traded, but get no price quotes from IB. The type FUTX can be used for downloading historical data of

expired futures contracts.

A example file AssetsIB.csv with currencies, CFDs, and stocks is included; we do however not guarantee the accuracy and correctness, so use it at your own risk.

Additional data and commands

The IB bridge supports the following additional data streams:

- marketVal: Not supported in historical data,

bid-ask spread in live data.

- marketVol: Trade volume per minute in historical

M1 data, per day in historical D1 data; accumulated volume since market open in live data. Only for exchange-traded assets, not for currencies.

Live volume is unfiltered; historical volume is filtered by delayed

transactions, busted trades, or unreportable trades. Returned stock volumes by

IB were reported to be off by factor 100, so the real volume at the exchange

is 100 times higher than the marketVol return.

Multiple IB accounts are supported. The account can be set

up in the account list.

The IB bridge supports the brokerCommand function with the following commands

(extra commands can be implemented

on user request):

- SET_PATCH

- GET_DELAY

- GET_WAIT

- SET_DELAY

- SET_WAIT

- SET_SERVER (sets the port number)

- SET_DIAGNOSTICS

- GET_POSITION (see remarks)

- GET_AVGENTRY

- GET_FILL

- GET_ACCOUNT

- SET_SYMBOL

- SET_MULTIPLIER

- SET_CLASS

- SET_LIMIT

- SET_PRICETYPE

(1 = ask/bid; 2 = last trade; 5

= ask, 6

= bid; 7 = adjusted; 8

= fast)

- SET_VOLTYPE

(3 = quote size; 4 = trade volume;

5 = ask size; 6 = bid size)

- SET_ORDERTYPE (2

= GTC order, 8 = stop order, 2+8 =

both)

- SET_ORDERTEXT ("ABC/DEF"

for order type ABC and Time-In-Force DEF)

- SET_ORDERGROUP (for OCA orders; have "MID" in the group

name for mid price trigger)

- SET_COMBO_LEGS

- GET_PRICE

- GET_VOLUME

- GET_TRADES

- GET_OPTIONS

- GET_FUTURES

- GET_FOP

- GET_CHAIN

- GET_UNDERLYING

- GET_BOOK (market depth must be

subscribed and the exchange must be coded in the asset symbol)

- GET_GREEKS

- DO_EXERCISE

- DO_CANCEL

Remarks

- Historical data is only available for

subscribed assets. Further limitations can be found under https://interactivebrokers.github.io/tws-api/historical_limitations.html. The assetHistory function can be used for downloading

T1, T2, M1,

and EOD history from IB. Downloading data in higher resolution than 1 minute is

slow due to IB's history limits. For long lookback periods or for special asset types, historical prices

might be only available in reduced resolution, such as 1 hour or 1 day.

Historical options data is not available. For

downloading index data, set the price type to "last trade". When

downloading large amounts or high resolution data, reduce the

request rate for avoiding API disconnections.

- Price data retrieving can take

up to 10 seconds per asset under some circumstances, for instance at session

start or for option and future

contracts. The

SET_PRICETYPE,8 command aborts price requests early and

can speed up price data remarkably. Downloading a contract chain can

take up to 30 minutes for large chains with > 10,000 contracts, for instance with SPY.

For this reason, it is recommended to call

contractUpdate not more frequently that once per day in live trading

mode. IB gives the following advice: For very large option chains,

unchecking the setting in TWS Global Configuration at API > Settings > "Expose entire trading schedule to

the API" will decrease the amount of data returned per option and

help to return the contract list more quickly. Not all price types are available for all assets at all time; some

price types are only available during market hours. Some derivatives -

for instance, currency CFDs - have no price data, so the underlying price

must be retrieved instead.

- Trades and orders. The IB API is NFA compliant and does not control individual trades. All trades

are therefore controlled by Zorro. The account portfolio only reflects the net sum of all open positions by all connected Zorros. The NFA flag

or an according NFA account list entry must be set for IB accounts.

Trades are IOC by default; partial fills are possible.

Avoid manually closing positions or cancelling

orders that were entered by Zorro. Since this is not reported

back by the API, it can cause the positions of Zorro and IB to get out fo

sync. If an order is not open anymore, it is normally assumed to be fully

filled. The

GET_POSITION command and the LotsPool variable can be used for comparing open positions between Zorro and IB. Use cancelTrade for removing manually closed positions.

Use enterTrade for converting an open IB position to

a Zorro-controlled trade.

Limit orders are supported with OrderLimit,

and GTC trade mode can be switched on with

TradeMode. Set TR_ENTRYSTOP for

adding a stop order to a trade; but be aware that the stop order is not

managed by Zorro. When orders are slow to execute - especially

option combos - increase the wait time (SET_WAIT

comand) or use TR_GTC. Since the IB API does not store trades

and does not update filled trades to Zorro, the only ways for

Zorro to find out if or when a GTC trade was filled is the

GET_POSITION command or the disappearance of

the GTC order. To emulate the filling of GTC trades by order disappearance,

use the TR_FILLED flag.

Use SET_ORDERTEXT

for sending special order types when the text contains a slash '/'.

The symbol before the slash, if any, is the order type; the symbol after the

slash, if any, is the time-in-force parameter (f.i. "MOC/"

for a market-on-close order or "MKT/OPG" for a market-on-open

order). Make sure not to use order types that cannot work together; some order

types require GTC mode and/or OrderLimit. A list of order types can be found

on

http://interactivebrokers.github.io/tws-api/basic_orders.html. Not all

order types work with all asset types.

Orders on advisor accounts are not (yet) supported by the IB plugin. Contact

us if you require an implementation.

- Market hours. Outside market hours - normally 9:30 .. 15:45 EST for US-traded assets - price quotes are not

always available, so you might get a "unavailable at this time"

warning. Therefore it is recommended to begin a session when the market is

open. If PRELOAD is set and the API does not respond to a price request, Zorro will attempt to retrieve the last known historical price. This is indicated by a "frozen price" message.

Orders executed outside market hours can have higher transaction costs, therefore trading outside market hours should be avoided.

- Asset parameters. Except for price and bid/ask spread,

no asset parameters are available through the IB API. Leverage, commission, pip cost, and lot size of traded assets must be

set up manually, either by script or in the asset list. Typical

maintenance leverage on a RegT account is 33 for most Forex pairs, 2 for stocks and ETFs, and 20 for CFDs. The parameters need not be 100% accurate, but should not be too far off in the interest of realistic backtests. You can find examples (with no guarantee of accuracy and correctness) of major currencies, CFDs, and stocks in the included file AssetsIB.csv.

- Price data. The price type can be selected with the

SET_PRICETYPE command between ask/bid

and last traded price and a special 'fast' price mode. By default the price

functions return the ask/bid price; if it is not available, the last traded price is

returned. Some assets, such as indices, have no ask/bid prices; index CFDs

have no last traded prices. An unavailable price type triggers error 053. Otherwise it is advisable to enforce the last traded price when the market

is closed, because ask/bid can then be very outdated.

Some index prices, such as VIX-IND-CBOE-USD and

VIX3M-IND-CBOE-USD, were reported to be only available after

VIX / VIX3M was entered in the TWS

watchlist (under Favorites).

- Positions. IB does not store trades, only net positions

are available via API. By default, positions are only available for exchange

traded products, not for forex pairs. Enable File /

Global Configuration / API / Include Virtual FX positions for

getting forex positions.

- Account status. The API provides a lots of account parameters, but none

of them is 100% equivalent to balance and equity. Therefore proxies are used: Equity is set to the

Net Liquidation Value, Balance

is set to Available Funds, and MarginVal is set to the Current Maintenance Margin. Non-US accounts sometimes

return account parameters in wrong currency immediately after connection. This is corrected after about a minute.

- Limited result accuracy. Profits displayed in the TWS by closing a trade can be very different from the real trade profit, since the API returns only the profit based on the average of all open positions. Total profit will also differ slighty because transactions costs and leverage can not be retrieved through the API, therefore approximate values are used on the Zorro side.

- Connection issues. The IB API will produce warnings during operation.

Most are harmless. The ominous mesages in the Gateway log "Invalid incoming request type 0" are

'heatbeat requests' of the IB API library and can be safely ignored.

The Gateway tends to log out and in by itself,

regularly once per day and sometimes also in irregular intervals, displaying messages like

"Connectivity between IB and Trader Workstation has been lost".

The connection to IB price servers is sometimes briefly interrupted with the message

"Data Farm connection lost". Re-login attempts by

the Gateway or the TWS were reported to temporarily block socket connections

on the PC, which can affect other parallel running sessions.

Zorro will automatically reconnect all lost connections and continue the sessions,

so user intervention is normally not required. You

can reduce connection issues by setting TickTime to

a higher value or by reducing the request rate.

- Single session only. You can not connect

twice with the same user name to the TWS, the Gateway,

or the IB website - not even for only checking your account.

You'll get a message like

"No market data during competing live session". When you log in with the TWS, the Gateway connection

might break down, or vice versa. After terminating your TWS session you must therefore manually re-login from the Gateway. Zorro will automatically resume the session after an interruption, but while not connected it can not handle entries, stops, or profit targets. For working around this problem, you can register a second user for your IB account, and open the TWS with this second user name.

This requires that you pay separate market data subscriptions for the second

user name. The workaround does not work for IB paper accounts, which are single-user only.

- No hibernation. The PC must not be reset, restarted, switched off, hibernate, or go in suspend mode while connected to the IB

TWS API. Otherwise the API may crash and require a Zorro restart.

Typical IB API error messages

- Requested market data is not subscribed: You forgot to

subscribe your assets. See above. Delayed market data is not available

with the IB API.

- Historical market data pacing violation: You

downloaded history that IB didn't want you to have. See https://interactivebrokers.github.io/tws-api/historical_limitations.html. Download less data in lower resolution.

- No security definition has been found: You entered a

wrong symbol in the asset list. See above how to

put together correct IB symbols. If you

don't know the symbol, exchange, or currency of a particular asset, enter it under

Favorites in the TWS and hit [Return].

You'll then normally get a list of proposals. This error message is

sometimes also issued when the symbol is correct, but a trade cannot be

entered due to order size limits or other reasons.

- Contract description ... is ambiguous: You

entered an incomplete symbol. If the same asset is traded on several

exchanges or in several countries, you need to include the exchange and/or

the currency as described above. If futures or options are available with

different multipliers, use the SET_MULTIPLIER

command before downloading prices.

- Error validating request - cause ...: A

command could not be executed for a reason listed under 'cause'.

- Order rejected - reason ...: A trade could not be opened

for the given reason.

- Price does not conform to the minimum price variation for this

contract: The given limit or stop price has too high precision. Use

the roundto function to round it to 1 pip or to the

smallest allowed increment.

- No market data due to competing live session: You

opened another TWS or Gateway session, possibly on a different device. You

must be looged out on all devices for using the IB API:

See also:

Brokers, Broker plugin,

MT4 bridge

► latest version online